In this article, we will discuss what are the risks of investing in crypto gems. Cryptocurrencies have been a topic of interest for many investors in recent years, with the rise of Bitcoin and other altcoins.

However, with the emergence of Crypto Gems, investors need to be aware of the risks involved in investing in these digital assets. CryptoGems are smaller cryptocurrencies with a low market cap and a high potential for growth.

While they may seem like a lucrative investment opportunity, investors must exercise caution before investing their hard-earned moneyin them.

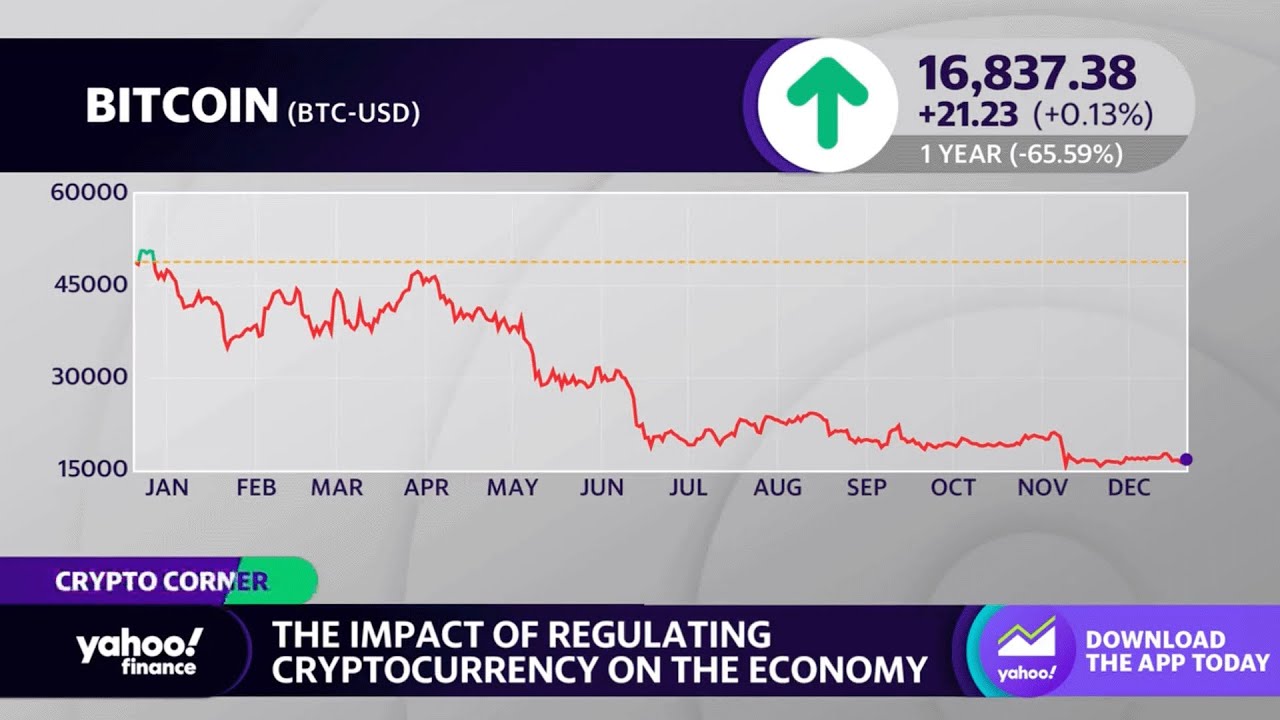

Lack Of Regulation

How crypto regulation could impact the global economy

One of the most significant risks associated with investing in Crypto Gems is the lack of regulation. Cryptocurrencies are not yet fully regulated by any government or financial institution, leaving them vulnerable to scams, fraud, and other illegal activities.

As Crypto Gems are typically smaller and less well-known than established cryptocurrencies like Bitcoin and Ethereum, there is a higher chance of fraudulent activities.

It is essential to thoroughly research any Crypto Gem before investing to avoid scams.

Volatility

Another significant risk of investing in Crypto Gems is their volatility. Due to their low market cap, Crypto Gems can experience significant price fluctuations, making them a high-risk investment.

Investors should be prepared for extreme price swings and be ready to act quickly to minimize losses. One way to mitigate this risk is to diversify your investment portfolio by investing in a mix of established cryptocurrencies and Crypto Gems.

Lack Of Liquidity

Liquidity refers to how easily a cryptocurrency can be bought or sold. As Crypto Gems are typically less well-known and have lower trading volumes, they may not be as liquid as more established cryptocurrencies.

This lack of liquidity can make it challenging to buy or sell Crypto Gems quickly, which can be a problem when investors need to cash out quickly.

Investors should be prepared to hold onto their Crypto Gems for a more extended period to avoid selling at a loss due to the lack of liquidity.

Lack Of Information

As Crypto Gems are smaller and less well-known than established cryptocurrencies, there may be a lack of information available about them. This can make it difficult for investors to make informed decisions about whether to invest in them or not.

Investors should conduct thorough research on any Crypto Gem they are considering investing in, including the project's whitepaper, team members, community involvement, and other relevant information.

How To Minimize Risks When Investing In Crypto Gems

The risks of crypto | 3 things to know before you invest in cryptocurrency

While there are risks involved in investing in Crypto Gems, investors can take steps to minimize those risks. Here are some steps to follow:

- Research- Thoroughly research any Crypto Gem before investing in it. Look for information about the project's goals, team members, community involvement, and other relevant information.

- Diversify- Diversify your investment portfolio by investing in a mix of established cryptocurrencies and Crypto Gems. This will help mitigate the risk of extreme price fluctuations and lack of liquidity.

- Set Limits- Set limits on how much you are willing to invest in Crypto Gems. This will help prevent you from investing more than you can afford to lose.

- Secure Your Investments- Keep your Crypto Gems secure by storing them in a secure wallet and using two-factor authentication. This will help prevent theft and loss due to hacks and scams.

How To Secure Your Crypto Gems Investment - Best Practices And Tips

Investing in Crypto Gems can be a high-risk, high-reward opportunity. However, with the high rewards come significant risks, such as hacking, phishing, and other forms of cybercrime.

Securing your Crypto Gems investment is crucial to protect your investment from potential theft and loss. Here are some best practices and tips to help you secure your Crypto Gems investment:

Use A Secure Wallet

A secure wallet is an essential tool for any Crypto Gems investor. A wallet is where you store your Crypto Gems, and it can be a software, hardware, or paper wallet.

A hardware wallet is the most secure way to store Crypto Gems, as it stores your private keys offline, making it difficult for hackers to access your funds. A software wallet is also a good option, but you must make sure to use a reputable and secure provider.

Enable Two-Factor Authentication

Two-factor authentication (2FA) is a security feature that adds an extra layer of protection to your account. It requires you to provide two pieces of information to access your account, such as a password and a unique code sent to your phone.

This extra layer of protection makes it more difficult for hackers to access your account, even if they have your password.

Keep Your Private Key Safe

Your private key is a secret code that gives you access to your Crypto Gems. It is essential to keep your private key safe and not share it with anyone.

Hackers can use your private key to access your Crypto Gems and transfer them to their own accounts. Keep your private key safe by storing it offline, using a hardware wallet or a paper wallet.

Use A Strong Password

A strong password is essential to protect your Crypto Gems investment. Your password should be at least 12 characters long and contain a mix of uppercase and lowercase letters, numbers, and symbols.

Do not use the same password for multiple accounts and avoid using easily guessable passwords such as your name, date of birth, or phone number.

Be Wary Of Phishing Attacks

Phishing attacks are a common tactic used by hackers to steal your Crypto Gems. They use social engineering to trick you into giving them your login credentials or private key.

Be wary of emails or messages asking you to provide your login details or private key. Always verify the sender's email address or phone number and do not click on any links unless you are sure they are safe.

Keep Your Software Up To Date

Keeping your software up to date is crucial to protect your Crypto Gems investment. Software updates often include security patches that address vulnerabilities and protect you from cyber threats.

Make sure to update your wallet software, operating system, and any other software regularly.

Diversify Your Investment

Diversification is a crucial strategy to reduce risk when investing in Crypto Gems. By spreading your investment across multiple Crypto Gems and other asset classes, you reduce your exposure to any one asset's volatility or risk.

Diversification can also help you capitalize on potential opportunities in different asset classes.

Investing in Crypto Gems can be a high-risk, high-reward opportunity. However, securing your investment is crucial to protect it from potential theft and loss.

By using a secure wallet, enabling two-factor authentication, keeping your private key safe, using a strong password, being wary of phishing attacks, keeping your software up to date, and diversifying your investment, you can minimize the risks and potentially reap the rewards of investing in Crypto Gems.

People Also Ask

Here are some common questions related to investing in Crypto Gems:

What Are Crypto Gems?

Crypto Gems are smaller cryptocurrencies with a low market cap and a high potential for growth. They are often less well-known than established cryptocurrencies like Bitcoin and Ethereum.

What Are The Risks Of Investing In Crypto Gems?

The risks of investing in Crypto Gems include lack of regulation, volatility, lack of liquidity, and lack of information.

How Can Investors Minimize Risks When Investing In Crypto Gems?

Investors can minimize risks when investing in Crypto Gems by conducting thorough research, diversifying their portfolio, setting limits on their investments, and securing their investments by using a secure wallet and two-factor authentication.

Are Crypto Gems A Good Investment?

Crypto Gems can be a high-risk, high-reward investment. While they have the potential for high returns, they also come with significant risks, such as lack of regulation and volatility. Investors should carefully consider their risk tolerance and investment goals before investing in Crypto Gems.

Conclusion

Investing in Crypto Gems can be a high-risk, high-reward investment opportunity. However, investors need to be aware of the risks involved, such as lack of regulation, volatility, lack of liquidity, and lack of information.

By conducting thorough research, diversifying their portfolio, setting investment limits, and securing their investments, investors can minimize these risks and potentially reap the rewards of investing in Crypto Gems.